8th Pay Commission Projection

Pay Commission Analysis

Economic Projections for Jan 2026

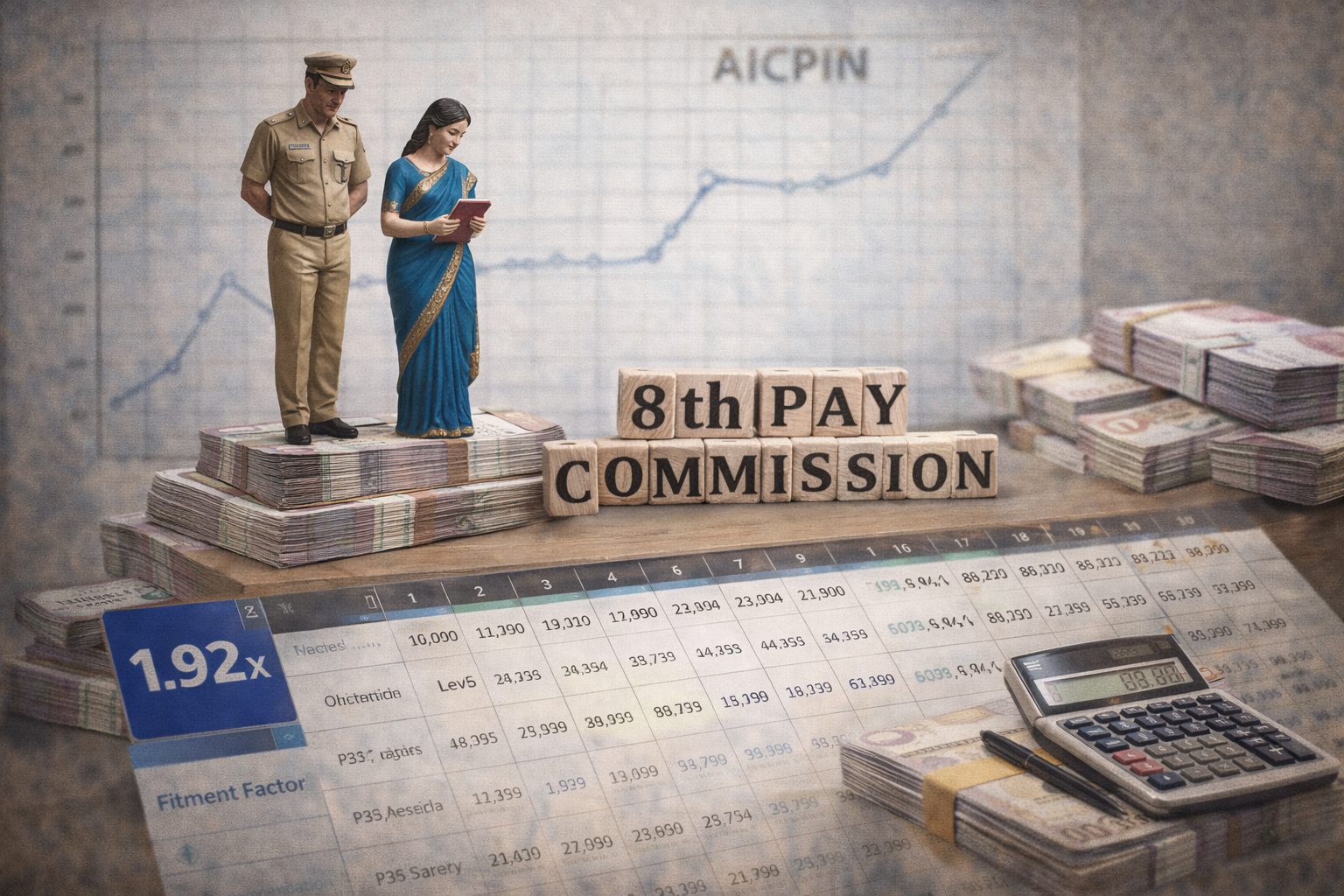

8th Pay Commission Salary Projection: Analyzing the 1.92 Fitment Factor vs Union Demands

- Current Status: Commission Constitution Awaited

- Projected Factor: 1.92 (Based on DA Merger)

- Union Demand: 2.86 (Based on Minimum Wage)

- Key Metric: AICPIN Inflation Index (2016=100)

The Economics Behind the “Fitment Factor”

For Central Government employees, the “Fitment Factor” is the multiplier that determines the transition from one Pay Commission to the next. While there is significant speculation about a 3.68 or 4.0 factor, a technical analysis of the Dr. Aykroyd Formula—which the government historically references—suggests a more conservative figure.

📊 Why 1.92 is the Statistical Probability

The calculation relies on the merger of the Dearness Allowance (DA).

• By January 2026, the DA is projected to reach approximately 60-64%.

• Historically, the government merges this DA into the Basic Pay and provides a Real Wage Increase of roughly 25-30%.

• The Math: (100% Basic + 60% DA) + 30% Hike ≈ 1.92 Multiplier.

Projected Pay Matrix (Level 1 to 10)

The table below illustrates how the Basic Pay may increase if the government accepts a 1.92 fitment factor. This projection helps in understanding the potential revision structure.

| Pay Level | Current Basic (7th CPC) | Projected Basic (8th CPC) | Potential Diff (Monthly) |

|---|---|---|---|

| Level 1 (MTS) | ₹18,000 | ₹34,560 | + ₹16,560 |

| Level 2 (LDC) | ₹19,900 | ₹38,208 | + ₹18,308 |

| Level 4 (UDC) | ₹25,500 | ₹48,960 | + ₹23,460 |

| Level 7 (ASO) | ₹44,900 | ₹86,208 | + ₹41,308 |

| Level 10 (GP A) | ₹56,100 | ₹1,07,712 | + ₹51,612 |

💡 Personal Estimation Tool:

To understand how these projections apply to your specific grade and increments, you can use the

Online Salary Projector here.

(This tool uses the same 1.92 logic for estimation purposes).

Understanding Potential Arrears

If the Pay Commission implementation is delayed beyond the scheduled date of January 1, 2026, employees are typically entitled to arrears.

The arrears represent the difference between the New Revised Pay and the Old Pay drawn during the interim period.

💰 The Arrears Logic

Arrears are not a “bonus” but a deferred payment.

Formula: (Revised Basic + Revised DA) – (Old Basic + Old DA) × Months of Delay.

Note: Generally, higher arrears accumulate if the notification is pushed to late 2026 or 2027.

Conclusion: Managing Expectations

While the demands for a minimum wage of ₹51,000 (Factor 2.86) are valid based on the rising cost of living, fiscal constraints often lead to a middle-ground solution. The 1.92 factor represents a realistic baseline for financial planning until the official Gazette Notification is released.