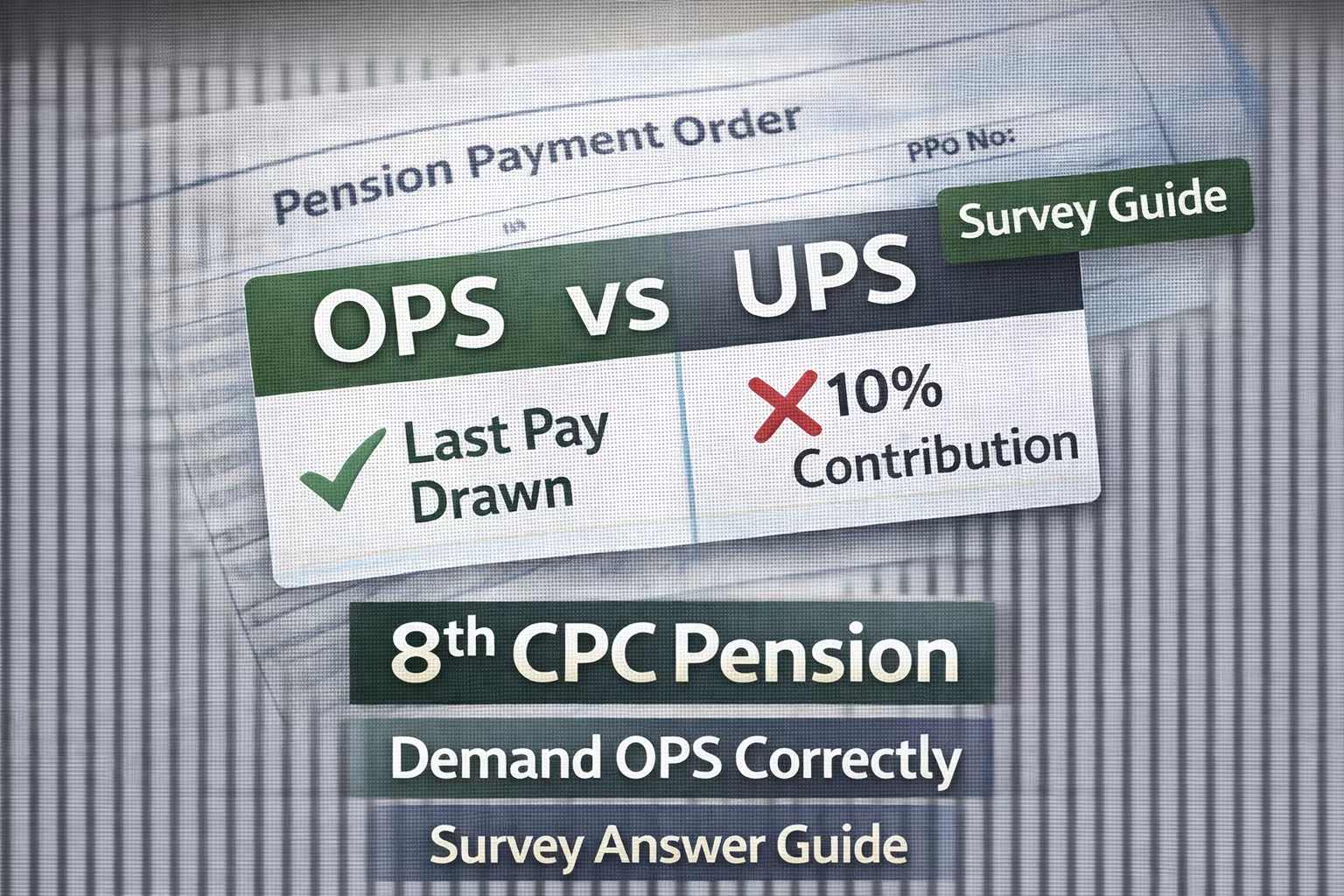

Financial Audit (Feb 2026): Subject: OPS vs UPS Comparison.

Verdict: UPS causes a Lifetime Loss of approx ₹42 Lakhs in corpus + Lower Monthly Pension.

The Trap: “Average Pay” calculation penalizes promotion years.

New Delhi: The choice between the Old Pension Scheme (OPS) and the Unified Pension Scheme (UPS) is not a political preference; it is a mathematical calculation of your life’s savings. While UPS offers a “Guaranteed 50% Pension,” our forensic audit reveals it effectively forces you to pay for your own downgrade. This report exposes the hidden financial losses in UPS that the 8th Pay Commission must address.

The “Self-Funding” Scam: In OPS, the government bore 100% of the pension liability. In UPS, YOU bear 10% of the cost every month, yet receive a pension calculated on a lower base (“Average Pay”) than OPS (“Last Pay”).

1. The “Average Pay” Deficit (Mathematical Proof)

The most critical difference is the formula. OPS used “Last Pay Drawn”. UPS uses “Average of Last 12 Months”. See how this destroys the benefit of your final year’s Increment or MACP.

| Scenario (Level 7 Retiree) | OPS (Last Pay Rule) | UPS (Average Pay Rule) | Net Loss |

|---|---|---|---|

| Calculation Base | ₹64,100 (Last Month) | ₹62,700 (12-Mo Avg) | Base Shrinks |

| Basic Pension (50%) | ₹32,050 | ₹31,350 | (-) ₹700 / Month |

| Dearness Relief (60%) | ₹19,230 | ₹18,810 | (-) ₹420 / Month |

| Total Annual Loss | Nil | ₹13,440 Loss | Lifetime Loss |

2. The ₹42 Lakh “Opportunity Cost”

This is the figure no one discusses. Under OPS, you contributed ₹0. Under UPS, you contribute 10%. If you had invested that 10% in a GPF/PPF (7.1% interest) instead, here is what you lose:

- Your Contribution (30 Years): Approx ₹12.5 Lakhs.

- Interest Lost (Compound): Approx ₹29.5 Lakhs.

- Total Corpus Vanished: ₹42 Lakhs.

Reality Check: In UPS, you hand over this ₹42 Lakh asset to the government, just to receive a pension that is lower than what OPS gave for free.

3. The Only Area UPS Wins: Family Pension

To be fair and balanced, there is one clause where UPS is superior. If the employee dies, the spouse gets a higher ratio under UPS.

OPS Rule (Standard)

Spouse gets 50% for 7 years, then reduced to 30% of Last Pay.

UPS Rule (Enhanced)

Spouse gets 60% of the Employee’s Pension until death. (No reduction).

However: Is it worth losing ₹42 Lakhs of your own money just for a slightly better family pension clause?

4. Action Plan: Official Survey Response

When filling Question 12 on 8cpc.gov.in, copy-paste this technical demand:

“Subject: Demand for Defined Benefit Pension on Last Pay Drawn.

The UPS model is financially inferior to OPS because: (1) It utilizes the ‘Average Pay’ formula, penalizing promotions; (2) It confiscates the employee’s 10% corpus (₹40L+ opportunity cost). I demand restoration of OPS (50% of Last Pay) with Zero Contribution, or a refund of the 10% corpus with interest upon retirement.”

Is the UPS pension taxable?

Yes. The monthly pension received under UPS is treated as “Salary Income” and is fully taxable as per your tax slab, just like OPS. However, the Lump Sum withdrawal (Gratuity/Commutation) has specific tax exemptions up to limits.

Can I switch back to OPS if 8th CPC recommends it?

If the government accepts the 8th Pay Commission’s recommendation to restore OPS, a “One-Time Option” will likely be given to all existing employees to switch from NPS/UPS to OPS. This precedent exists (e.g., 2003 batch).

हिंदी सारांश: OPS बनाम UPS (वित्तीय ऑडिट)

बड़ा धोखा: UPS में आपकी पेंशन “औसत वेतन” (Average Pay) पर बनती है, जिससे हर महीने ₹1000 का नुकसान होता है।

42 लाख का घाटा: OPS में आपकी जेब से 0 रुपये लगते थे। UPS में 10% कटता है, जो रिटायरमेंट तक ब्याज मिलाकर ₹42 लाख होता है। आप यह पैसा खो रहे हैं।

सच्चाई: UPS सिर्फ “फैमिली पेंशन” (60%) में बेहतर है, लेकिन कर्मचारी की खुद की पेंशन और जमा पूंजी (Corpus) के लिए यह घाटे का सौदा है।