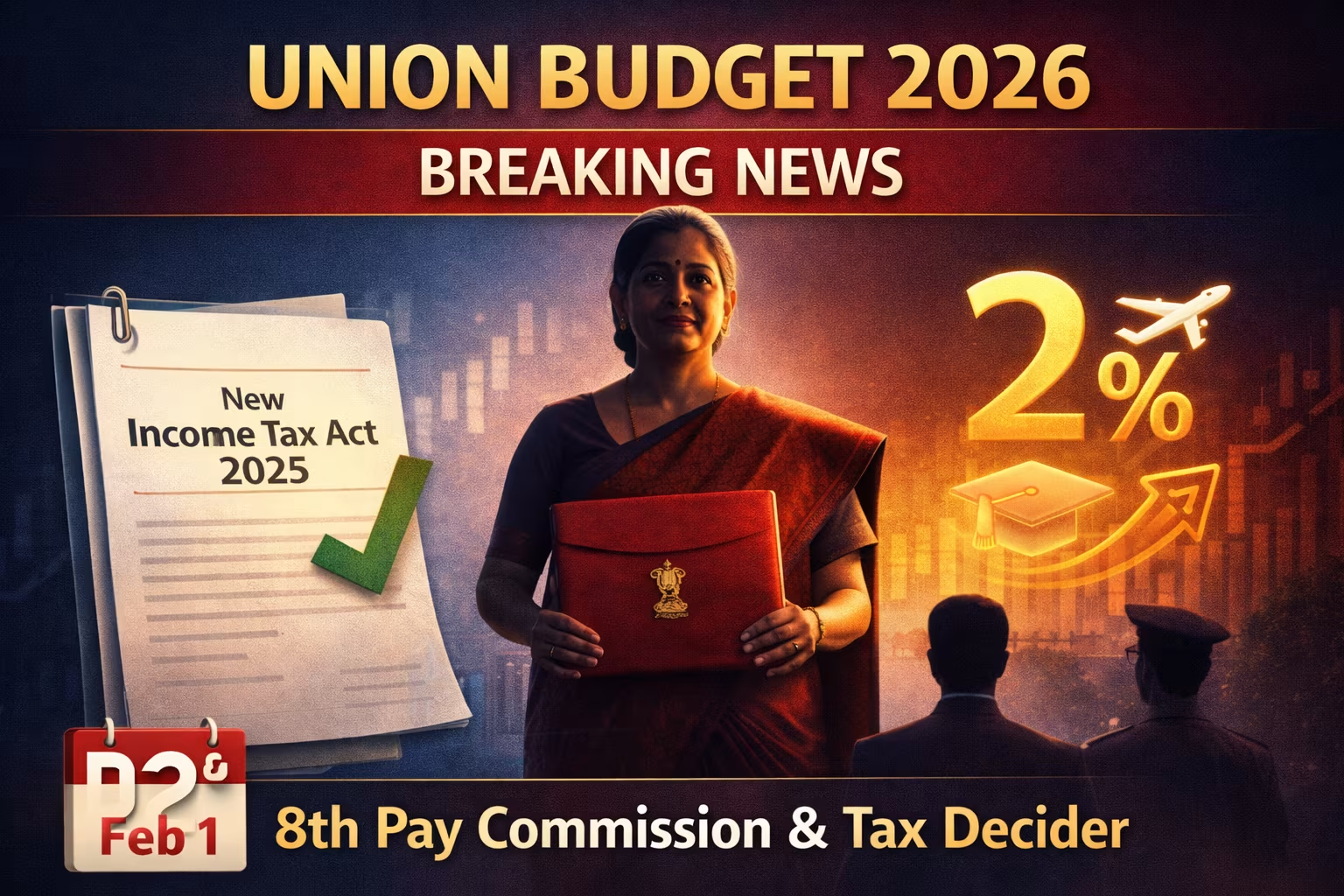

As on February 1, 2026, Finance Minister Nirmala Sitharaman has presented the Union Budget 2026-27, announcing a historic overhaul of the tax system. The government has decided to scrap the 6-decade-old Income Tax Act of 1961 and introduce the new “Income Tax Act, 2025” to simplify taxation for millions of Indians.

Key Announcements: New Tax Act & TCS Cut

The Budget 2026 introduces major structural changes aimed at reducing the compliance burden and providing relief to international travelers and students. The new Act will come into effect from April 1, 2026.

⚠️ Official Status: These are proposals introduced in the Finance Bill, 2026. They will become law once passed by the Parliament and receiving Presidential assent.

✅ Big Relief: Tax Collected at Source (TCS) on foreign tour packages and education remittances has been slashed to a flat 2%.

What Gets Cheaper & Costlier?

The Budget has rationalized customs duties and taxes. Here is the impact on your wallet:

| Item / Service | Change Type | Impact |

|---|---|---|

| Foreign Tour Packages | TCS Cut (5%/20% to 2%) | 📉 Cheaper |

| Mobile Phone Parts | Customs Duty Reduced | 📉 Cheaper |

| Cancer Medicines | Duty Exempted | 📉 Cheaper |

| F&O Trading | STT Hiked (to 0.05%/0.15%) | 📈 Costlier |

| Share Buybacks | Taxed as Capital Gains | 📈 Costlier |

The hike in Securities Transaction Tax (STT) on Futures & Options is intended to curb speculative trading in the derivatives market.

📥 OFFICIAL BUDGET DOCUMENTS

Download the full text of the Finance Minister’s speech and the official “Key Features” document directly from the government source.

- 📂 Document 1: Budget Speech 2026-27 (PDF)

- 📂 Document 2: Key Features of Budget (PDF)

- 📅 Date: 01 February 2026

हिंदी सारांश

वित्त मंत्री निर्मला सीतारमण ने बजट 2026 में ‘आयकर अधिनियम 2025’ लाने की घोषणा की है, जो 1961 के पुराने कानून की जगह लेगा। इसके अलावा, विदेश यात्रा और शिक्षा के लिए विदेश पैसे भेजने पर TCS की दर को घटाकर 2% कर दिया गया है। शेयर बाजार में F&O ट्रेडिंग पर STT बढ़ा दिया गया है, जबकि मोबाइल और कैंसर की दवाएं सस्ती होंगी।

📲 WhatsApp पर शेयर करने के लिए संक्षेप