DFS Launches Composite Salary Account Package 2026 (Ministry of Finance Update)

- Status: Scheme Launched / MoU Signed

- Source: Department of Financial Services (DFS)

- Reference: DFS / PSU Bank MoU 2026

- Key Benefit: Personal Accident Cover up to ₹1.5 Cr (Free)

Last verified with official sources: January 19, 2026

What Changed: Unified Salary Benefits

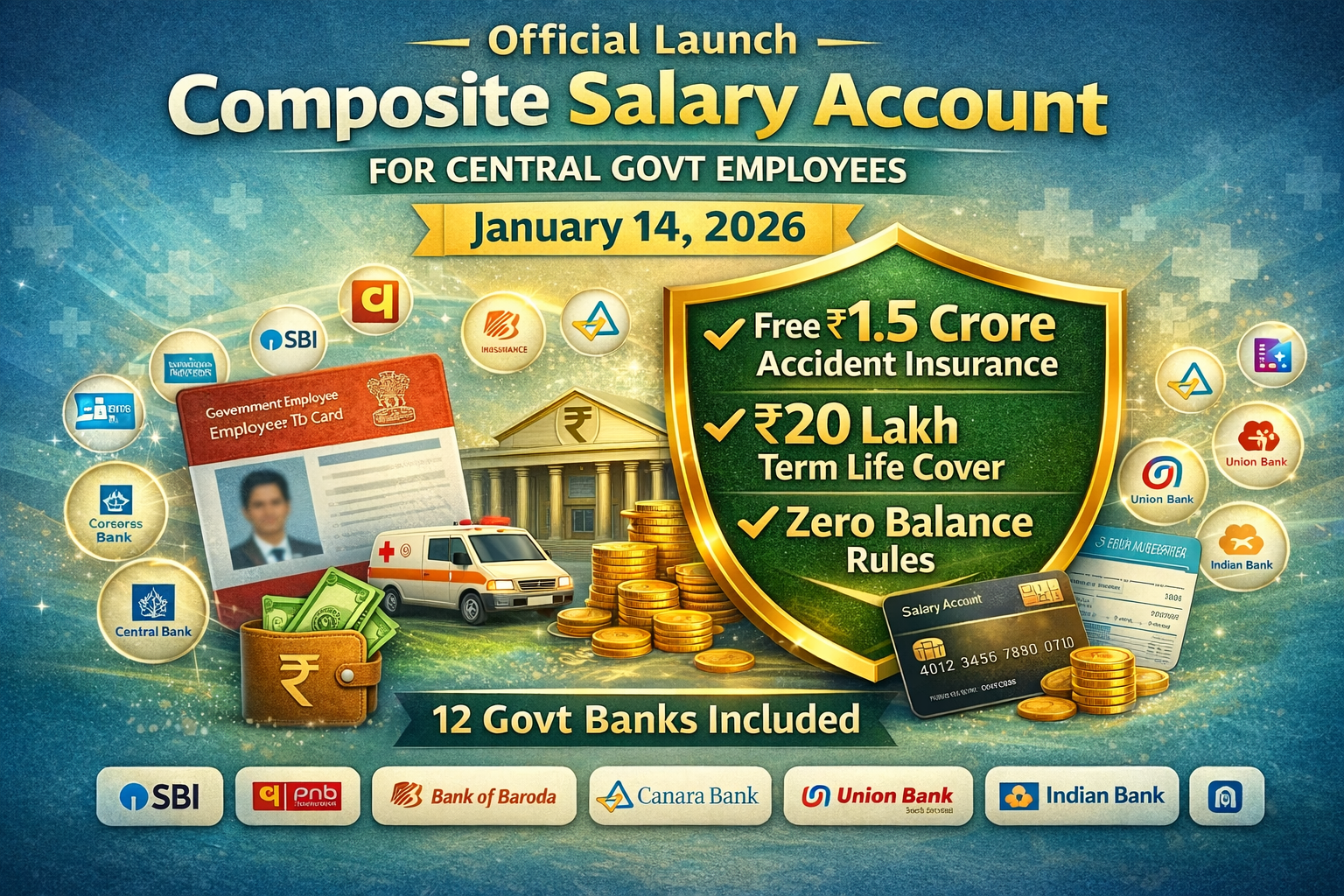

New Delhi: The Department of Financial Services (DFS), Ministry of Finance, has launched the “Composite Salary Account Package” for Central Government employees. This initiative standardizes the benefits offered by Public Sector Banks (PSBs) to government staff, ensuring that benefits like insurance coverage are not discretionary but guaranteed under the MoU.

✅ Official Launch Update

Authority: Department of Financial Services (DFS)

Subject: Unified Salary Account Framework (Composite Package)

Applicable Banks: Major PSBs (SBI, PNB, BoB, Canara, etc.)

Objective: To provide a one-stop financial solution with enhanced insurance covers.

Eligibility Criteria

✔ Eligible

- Permanent Central Govt Employees.

- Employees drawing salary through PSBs.

- Existing account holders who convert their account code.

✖ Not Eligible

- Employees drawing salary via Cheque/Cash.

- Accounts not tagged with the specific “Salary Package” Product Code (P-Code) at the bank level.

Revised Benefits (Financial Security)

Previously, insurance benefits varied by branch and negotiation. The Composite Package mandates specific coverage limits based on the MoU.

- Old Scenario: Standard Savings Account (Zero Insurance) or low cover (₹5-10 Lakh).

- New Provision: Structured “Salary Package” with tier-based insurance (Level 1 to Level 18).

💰 Benefit Illustration (Insurance & Overdraft)

| Feature | Normal Savings A/c | Composite Salary Package | Net Benefit |

|---|---|---|---|

| Accident Insurance (Death) | ₹ 0 | ₹ 40 Lakh – ₹ 1.5 Cr* | Full Cover (Free) |

| Air Accident Cover | ₹ 0 | ₹ 1 Cr (Approx) | High Security |

| Overdraft (Loan) | Not Available | 2 Months Salary | Instant Liquidity |

| Processing Fees | 100% Charges | Waived (Home/Auto/Personal) | Save ₹5k-10k |

*Note: Exact insurance amount depends on your Pay Level and the specific Bank’s MoU tier (e.g., Gold, Diamond, Platinum).

🚨 The “Product Code” Trap (Critical Audit Point)

Your insurance claim will be REJECTED if:

- The Bank Branch has not changed your account code from “Savings” to “Salary Package”.

- Your salary is not credited for 2-3 consecutive months (Policy lapses).

- The “Nomination” details are not updated specifically for the insurance component.

Action: Check your Passbook/Netbanking. It must say “Govt Salary Package” (or similar), NOT “Savings Bank General”.

How to Apply (Draft Text for Bank)

Most accounts are not upgraded automatically. Submit this application to your Bank Manager to ensure the code is updated:

“I am a Central Government Employee drawing salary in this account [Account No]. I request you to convert my existing Savings Account to the [Bank Name] ‘Central Govt Salary Package’ (Composite Scheme) with immediate effect.

Please ensure the correct Product Code is updated in the system to enable the complimentary Personal Accident Insurance and other MoU benefits. My employment proof is attached.”

Procedure for Employees

- Step 1: Visit your salary bank branch.

- Step 2: Submit a copy of your latest Pay Slip and ID Card.

- Step 3: Ask for a written confirmation or printout showing the new “Product Code”.

📢 Instant WhatsApp Share

Review the summary below, then click the green button to share instantly:

FAQs

Is this applicable to existing accounts?

Yes, but you must request the branch to change the “Product Code” (P-Code) to the specific Govt Salary Package scheme.

Does it cover natural death?

No, the complimentary cover is usually for Personal Accident (Death/Disability). Life insurance (natural death) is generally not included unless specified.