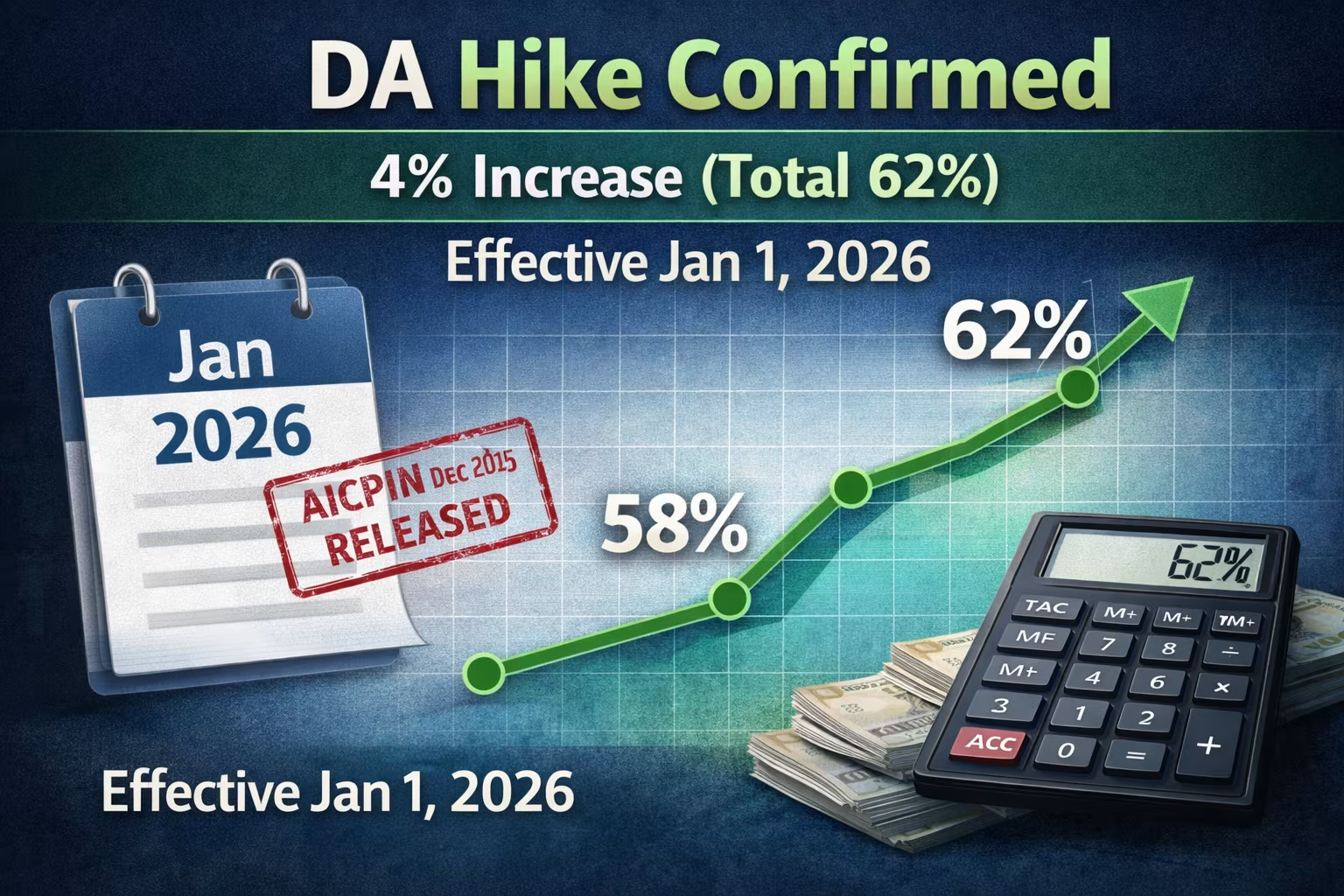

News Alert: The Labour Bureau, under the Ministry of Labour and Employment, released the final All India Consumer Price Index for Industrial Workers (AICPIN-IW) for December 2025 on January 31, 2026. This data point was the final component required to calculate the exact Dearness Allowance (DA) hike effective from January 1, 2026.

Based on the confirmed 12-month average of the AICPIN index, the Dearness Allowance for Central Government Employees and Dearness Relief (DR) for Pensioners has crossed the threshold for a 4% hike, taking the total DA from 58% to 62%. While the official Cabinet approval is expected in March 2026, the mathematical calculation is now locked.

• Existing DA: 58%

• New DA (Jan 2026): 62%

• Status: Data Released, Cabinet Approval Pending.

The Mathematical Basis: How 62% was Confirmed

To understand why the hike is confirmed at 4% and not 3% or 5%, employees must look at the 7th Pay Commission DA formula. The DA is not decided arbitrarily; it is based on the 12-month average of the AICPIN-IW (Base Year 2016=100).

The Official Data Stream (July 2025 – Dec 2025):

The second half of 2025 saw significant fluctuations in the Consumer Price Index, driven largely by food inflation and housing components. Here is the month-by-month breakdown that led to the final figure:

| Month | AICPIN Index (2016=100) | 12-Month Average | DA % (Calculated) |

|---|---|---|---|

| July 2025 | 144.2 | 140.58 | 58.65% |

| Aug 2025 | 144.9 | 141.25 | 59.32% |

| Sept 2025 | 145.6 | 142.04 | 60.15% |

| Oct 2025 | 146.4 | 142.95 | 61.02% |

| Nov 2025 | 146.9 | 143.82 | 61.88% |

| Dec 2025 | 146.5 | 144.60 | 62.42% |

The Rounding Off Rule:

The calculated DA percentage stands at 62.42%. As per government rules, fractions are ignored. Therefore, the final DA is rounded down to the nearest integer, which is 62%. If the index had pushed the average to 62.51%, the DA would have jumped to 63%, but we narrowly missed that mark.

Impact on Salary: Level-Wise Calculator

With the DA rising to 62%, every Central Government Employee will see a proportionate increase in their take-home pay. The increase is calculated on the Basic Pay only. Allowances that are indexed to DA (like Transport Allowance) will also see a marginal rise in their net value.

Note for Accounts Officers: The arrears for January and February 2026 will likely be paid in the salary of March 2026 (paid in April), or via a separate supplementary bill before the financial year ends.

1. Impact on Level 1 (Entry Level Staff)

- Basic Pay: ₹18,000

- Old DA (58%): ₹10,440

- New DA (62%): ₹11,160

- Monthly Increase: ₹720

- 3-Month Arrears (Jan-Mar): ₹2,160

2. Impact on Level 6 (Group B Non-Gazetted)

- Basic Pay: ₹35,400

- Old DA (58%): ₹20,532

- New DA (62%): ₹21,948

- Monthly Increase: ₹1,416

- 3-Month Arrears (Jan-Mar): ₹4,248

3. Impact on Level 10 (Section Officer / Gazetted)

- Basic Pay: ₹56,100

- Old DA (58%): ₹32,538

- New DA (62%): ₹34,782

- Monthly Increase: ₹2,244

- 3-Month Arrears (Jan-Mar): ₹6,732

Employees can verify their exact basic pay in the Latest 7th Pay Matrix Level 7 Salary 2026 In Hand Calculation guide to perform their own specific calculation.

Pensioners Corner: Dearness Relief (DR) Update

For Central Government Pensioners, the Dearness Relief (DR) follows the same pattern. The DR will increase from 58% to 62%. This increase applies to the Basic Pension (before commutation deduction).

Commutation Confusion Clarified:

Many pensioners ask if the DR is calculated on the reduced pension after commutation. The answer is NO. DR is always calculated on the Gross Basic Pension (the original pension amount). Therefore, the 4% hike applies to your full entitlement.

• Basic Pension: ₹30,000

• DR Increase (4%): ₹1,200 per month

• Yearly Benefit: ₹14,400

Pensioners should also stay updated on the status of the restoration period. Read the Latest Pension Commutation Restoration 15 Vs 12 Years Analysis for ongoing legal discussions regarding the 12-year demand.

Will Allowances Increase with this DA Hike?

A common query is whether House Rent Allowance (HRA) or Transport Allowance (TPTA) will increase with this DA hike.

1. House Rent Allowance (HRA)

No change. HRA rates were revised when DA crossed 25% and 50%. The next revision will only occur when DA crosses 100%. Since DA is currently at 62%, the HRA rates remain at 30%, 20%, and 10% for X, Y, and Z cities respectively.

2. Transport Allowance (TPTA)

No change in Base Rate. The base TPTA remains the same. However, since the TPTA itself is indexed to DA (TPTA + DA on TPTA), the net amount of Transport Allowance will rise automatically because the DA component on it has increased from 58% to 62%.

3. Gratuity Ceiling

No change. The Gratuity ceiling was hiked to ₹25 Lakh when DA crossed 50%. It will not increase again until the next Pay Commission or specific notification.

Income Tax Implications (FY 2025-26 & 2026-27)

Since these arrears (Jan-Mar) will likely be paid in March 2026, they will fall under the Financial Year 2025-26 for tax purposes. This sudden influx of arrears might push some employees into a higher tax slab right at the end of the financial year.

Tax Tip: If the arrears are paid after March 31 (i.e., in April salary), they will be taxed in FY 2026-27. However, usually, the government attempts to clear DA arrears within the current financial year to balance the books. Employees should check if they need to submit a revised Latest Income Tax Investment Proof Submission Deadline Jan 2026 Form 12bb to avoid excess TDS deduction in March.

When will the Official Order be Issued?

Historically, the timeline for the January DA hike follows a set pattern:

- Jan 31: Release of December AICPIN Data (Completed).

- Mid-March: Proposal moved by Finance Ministry to Cabinet.

- Late March (Holi usually): Cabinet Approval & Press Conference.

- Last Week of March: DoPT / FinMin Order issued.

- March Salary (Paid in April): Disbursal of new rate + 2 months arrears.

Therefore, employees should not expect the increased salary in their February pay slip. The enhanced pay will reflect in the salary credited on the last working day of March or April 2026.

Is the DA hike of 4% confirmed?

Mathematically, yes. The AICPIN data average for 12 months is 144.60, which translates to 62.42%. Ignoring the fraction, the DA stands at 62%, which is a 4% increase over the existing 58%.

Will DA merge with Basic Pay at 60%?

No. There is no recommendation in the 7th CPC to merge DA with Basic Pay at 60%. DA will continue to rise until the 8th Pay Commission is implemented. Merger usually happens only during a new Pay Commission constitution.

Will I get arrears for January and February?

Yes. Since the effective date is January 1, 2026, and the order usually comes in March, you will receive arrears for January and February along with your updated salary.

हिंदी सारांश

लेबर ब्यूरो ने 31 जनवरी 2026 को दिसंबर 2025 का AICPIN इंडेक्स जारी कर दिया है। इस डेटा के आधार पर जनवरी 2026 से महंगाई भत्ते (DA) में 4% की बढ़ोतरी तय हो गई है। अब केंद्रीय कर्मचारियों का डीए 58% से बढ़कर 62% हो जाएगा। इसका ऐलान होली के आसपास मार्च महीने में होने की उम्मीद है। बढ़ा हुआ पैसा और जनवरी-फरवरी का एरियर मार्च की सैलरी के साथ मिलने की संभावना है।

📲 WhatsApp Share Summary