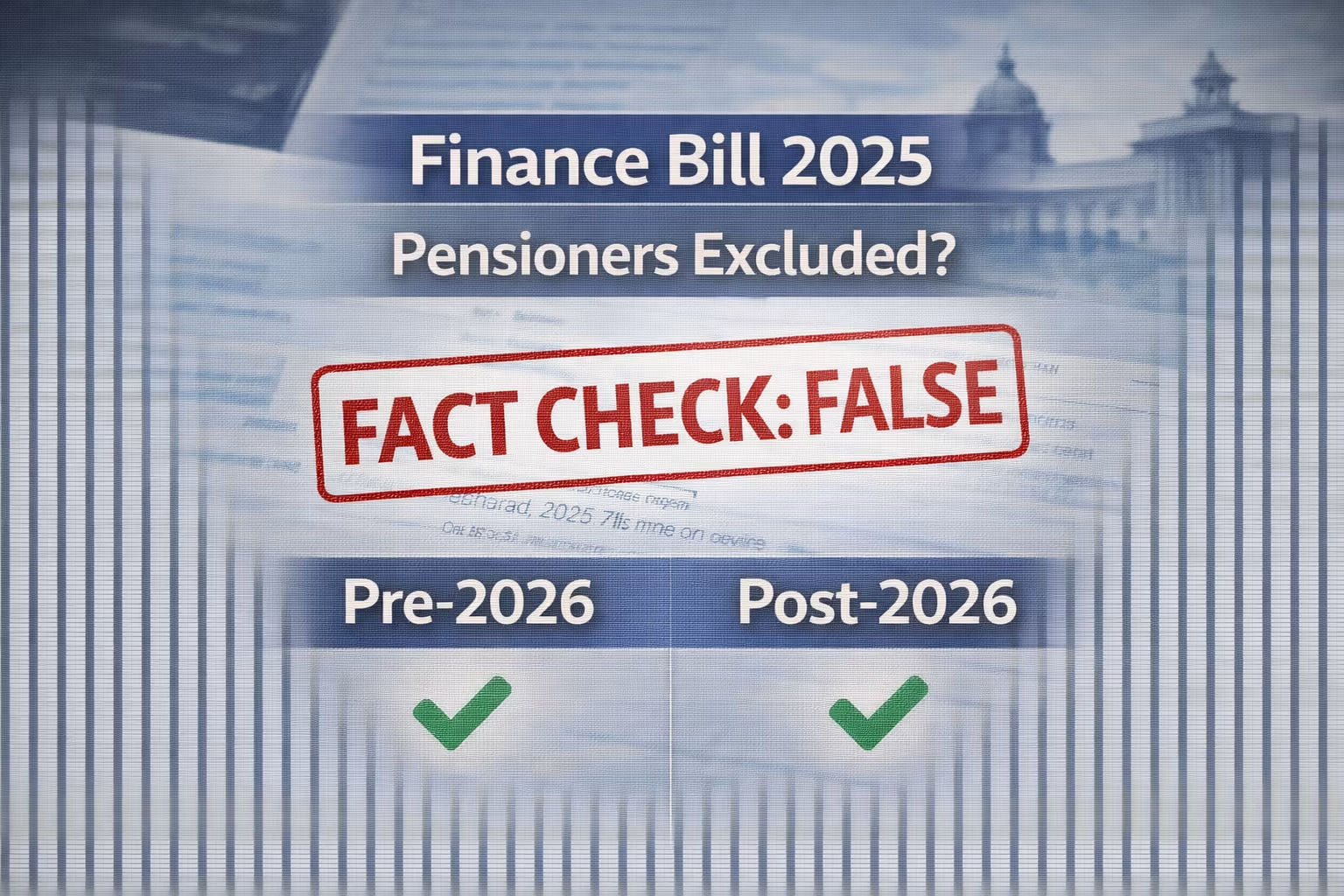

No provision in the Finance Bill 2025 excludes pre-2026 pensioners from the 8th Pay Commission. Central Government pensioners retiring before January 1, 2026, will be covered under the standard pension revision protocol, typically using a Concordance Table or a fixed Fitment Factor (projected at 1.92). The rumors circulating regarding a “distinction” between old and new pensioners in the Finance Bill are administrative misinterpretations of tax amendment clauses, not pay commission terms.

Finance Bill 2025 vs 8th Pay Commission Applicability

Confusion has arisen among pensioners following the presentation of the Finance Bill 2025. Messages circulating on WhatsApp groups suggest that the Bill creates a separate category for retirees up to 31 December 2025, effectively denying them 8th CPC benefits. As a Senior Accounts Officer, I must clarify that the Finance Bill deals strictly with Revenue, Income Tax, and Expenditure allocations. It does not define the Terms of Reference (ToR) for a Pay Commission.

Clarification: The Pay Commission is constituted by a separate notification from the Ministry of Finance (Department of Expenditure), not through the Finance Bill. No such notification excluding past pensioners exists.

Historically, every Central Pay Commission (4th, 5th, 6th, and 7th) has included specific provisions for revising the pension of existing retirees. This ensures “parity” between past and current pensioners. The 7th CPC introduced the “Notional Pay” method (Option 1) and the “2.57 Fitment” method (Option 2) specifically to protect pre-2016 pensioners. The 8th CPC is expected to follow a similar legal precedent.

Pension Revision Formula: The Mathematical Reality

Pensioners should understand the calculation logic rather than relying on unverified forwarded messages. If the 8th Pay Commission is implemented from January 1, 2026, the revision for existing pensioners typically follows one of two methods.

- Method A (Consolidated): Existing Basic Pension × Fitment Factor. (e.g., ₹25,000 × 1.92 = ₹48,000).

- Method B (Notional): Fixation of pay in the new Pay Matrix corresponding to the level from which the employee retired.

For a detailed breakdown of how fitment factors impact salary and pension, you can review the 8th Pay Commission Fitment Factor Explained for Central Govt Employees. The factor of 1.92 is currently being discussed as a baseline based on Aykroyd formula adjustments, though unions are demanding 3.68. Retirement Date Applicability of 8th CPC Basis of Calculation Before 31 Dec 2025 Yes (Pension Revision) Notional Pay / Fitment Factor On/After 01 Jan 2026 Yes (Salary Revision) New Pay Matrix Level

Why the “Distinction” Rumor Started

The rumor likely stems from a misreading of the “Expenditure Profile” in the Budget documents or the Nationwide Strike 12 Feb 2026 8th Pay Commission Bank Closure Dies Non Rules which highlighted disparities in the Old Pension Scheme (OPS) vs Unified Pension Scheme (UPS). The distinction in the Finance Bill 2025 pertains to tax treatment on arrears and standard deduction limits for family pensioners, not their eligibility for the Pay Commission itself.

Note on Arrears: If the implementation is delayed beyond January 2026, arrears will accrue. Pensioners can use the 8th Cpc Arrears Calculator Formula Salary Hike to estimate potential lump-sum payments based on current DA trends.

Status of Official Orders

As of 17 February 2026, the Department of Pension & Pensioners’ Welfare (DoPPW) has not issued any OM distinguishing between pre-2026 and post-2026 retirees for the purpose of the 8th CPC. The “Terms of Reference” for the commission, once finalized, will explicitly mention “Revision of Pension for existing pensioners.” Until then, any claim of exclusion is technically incorrect and legally untenable under the OROP (One Rank One Pension) judicial principles applied to civil services.

Audit Observation: Pensioners are advised to ignore social media speculation. Official pension revision orders are typically issued by DoPPW only after the Pay Commission report is accepted by the Cabinet. Does Finance Bill 2025 stop 8th Pay Commission for old pensioners?

No. The Finance Bill deals with taxation and budget allocation. It does not determine the eligibility criteria for Pay Commission benefits. Will pre-2026 retirees get the 1.92 fitment factor?

No Official Order Issued Yet. However, standard protocol suggests a fitment factor will be applied to the existing basic pension to arrive at the revised pension. Is there a separate committee for pensioners?

Usually, the same Pay Commission covers both serving employees and pensioners. No separate committee has been notified as of February 2026.

हिंदी सारांश

वित्त विधेयक 2025 में ऐसा कोई नियम नहीं है जो 2026 से पहले सेवानिवृत्त हुए कर्मचारियों को 8वें वेतन आयोग से बाहर करता हो। सोशल मीडिया पर चल रही खबरें कि पुराने पेंशनभोगियों को लाभ नहीं मिलेगा, पूरी तरह गलत हैं। वेतन आयोग की सिफारिशें सभी पेंशनभोगियों पर लागू होती हैं, चाहे वे कभी भी सेवानिवृत्त हुए हों। सरकार ने अभी तक पेंशन संशोधन पर कोई आधिकारिक आदेश जारी नहीं किया है।

📲 WhatsApp पर शेयर करें और ग्रुप जॉइन करें

🚨 Pensioner Fact Check ✅ क्या 2026 से पहले रिटायर हुए लोगों को 8th Pay Commission नहीं मिलेगा? ✅ Finance Bill 2025 की सच्चाई जानें। 👇 अभी पढ़ें और भ्रम दूर करें https://central8thpaycommission.com/finance-bill-2025-pensioner-exclusion-fact-check/ Share On WhatsApp

📥 Download Fact Check Note (PDF)

Disclaimer: This article is for informational purposes based on the Finance Bill 2025 text and existing pension rules. No official 8th CPC Pension order has been issued by the Government of India as of Feb 17, 2026.