Gratuity Clarification 2026

Gratuity Limit ₹20 Lakh

Mandatory for CPSEs (Affordability No Excuse)

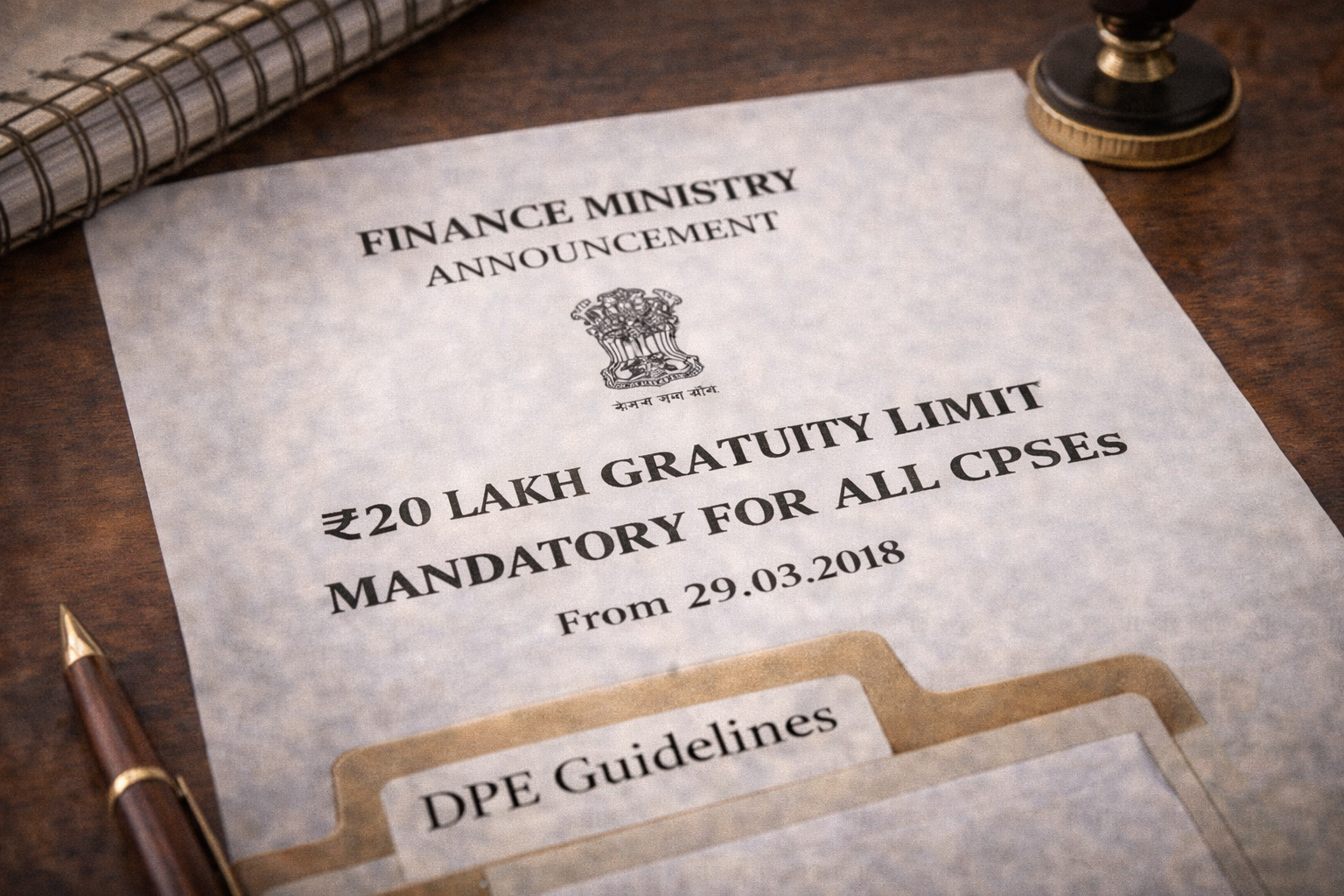

Gratuity Limit ₹20 Lakh Now Mandatory: Finance Ministry Clarifies Rules for CPSE Employees

- Old Limit: ₹10 Lakh

- New Limit: ₹20 Lakh

- Effective Date: 29 March 2018

- Condition: Mandatory (Irrespective of Loss/Profit)

The “Affordability” Excuse Ends

The Department of Public Enterprises (DPE) has issued a consolidated guideline that puts an end to the confusion. Many PSUs (CPSEs) were denying the enhanced Gratuity of ₹20 Lakh citing “losses” or “affordability”.

✅ The Final Verdict

From 29.03.2018 Onwards:

The payment of Gratuity up to ₹20 Lakh is MANDATORY for all CPSEs.

• It is a statutory right under the Amended Gratuity Act.

• The company cannot say “We don’t have money”.

Who Benefits?

This order applies to:

👷 Employees

All Executives, Non-Unionised Supervisors, and Workmen of Central Public Sector Enterprises (CPSEs).

📅 Retirees

Anyone who retired on or after March 29, 2018, and was paid less Gratuity can now claim the arrears.

Difference from 7th Pay Commission

Central Govt Employees got the ₹20 Lakh limit from 01.01.2016. However, for CPSE employees, the date is different.

| Category | Effective Date for ₹20 Lakh |

|---|---|

| Central Govt Employees | 01.01.2016 |

| CPSE Employees | 29.03.2018 |