Latest Updates

CPSE Gratuity Rules 2026: DPE Consolidated Guidelines & Calculation

DPE issues Consolidated Guidelines for CPSE Gratuity 2026. Check 15/26 calculation rule, ₹20 Lakh limit, and forfeiture conditions. Download calculation formula.

🏛️ Ministry of Finance Department of Expenditure (Pay Research Unit) 🔍 ☰ 8th Pay Matrix Level 1: MTS New Basic Pay & Salary Chart (Projected 2026) Status: Projection (Based on AICPI) Target Cadre: MTS / Group D (Level 1) Current Basic: ₹18,000 (7th CPC) Expected Basic: ₹34,560 (at 1.92 Fitment) 📲 Join Official WhatsApp Channel What Changed: The Minimum Wage Battle As the 8th Pay Commission begins its deliberations, the most critical figure is the Level 1 Entry Pay (Minimum Wage). While the Unions are demanding a hike to ₹51,900 based on the 15th ILC norms (Aykroyd Formula), the government’s internal calculation based on the 1.92 Fitment Factor (DA Merger method) projects the new minimum basic pay at approximately ₹34,560. This figure will replace the current ₹18,000 for all new MTS recruits. ✅ Projection Basis Formula: Basic Pay + DA (62% Projected) + Fitment Benefit Current Status: Unions Demanding 3.68 Fitment Factor 👉 Check Pay Commission Terms The New Protocol: Level 1 Matrix The entire Level 1 Pay Matrix (Index 1 to 40) will be revised. This impacts Multi-Tasking Staff (MTS), Helpers, and entry-level Group D employees. ✔ Likely Scenario (1.92 Factor) Entry Pay: ₹34,560. Logic: Merging 62% DA with...

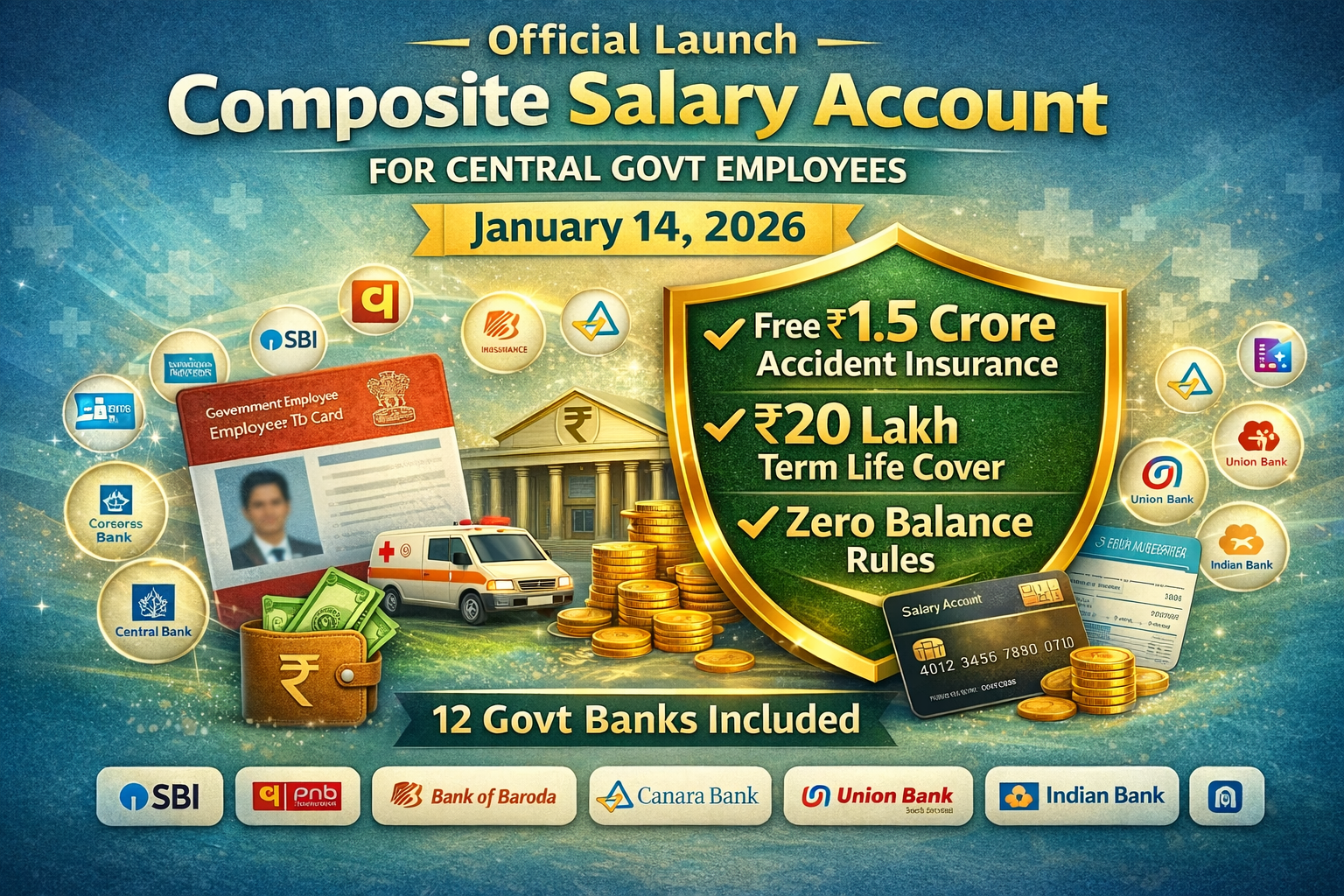

Composite Salary Account Package 2026: Free ₹1.5 Cr Insurance & Loan Benefits

Official Launch: Composite Salary Account for Central Govt Employees (Jan 14, 2026). Free ₹1.5 Cr Accident Insurance, ₹20 Lakh Term Life Cover & Zero Balance Rules. List of 12 Banks included.

PSGIC Wage Revision 2026: 17% Hike Approved, Arrears & Pension Rules

Govt approves Wage Revision for PSGIC, NABARD & RBI. Check 17% Salary Hike chart, Family Pension update, and Arrears calculation from Aug 2022.

TA on Retirement 2026: CTG Limit, Luggage Rates & Car Transport Rule

Retiring in 2026? Check TA on Retirement Rules. CTG = 80% of Basic Pay. Transport rates hiked by 25% due to DA. Download claim form & calculator.

Small Savings Rates Unchanged: PPF, NSC, SSY Rates for Jan-Mar 2026

By Central 8th Pay Commission Admin Fixed Income Stability: Ministry of Finance Keeps Small Savings Rates Unchanged for Q4 FY 2025-26 Published: Dec 31, 2025 | 22:15 IST NEW DELHI: In a move that provides continued predictability for millions of household savers, the Government of India has decided to keep interest rates on various Small Savings Schemes unchanged for the fourth quarter of the current fiscal year (January 1, 2026, to March 31, 2026). This decision, notified via an official statement from the Ministry of Finance on December 31, 2025, marks the seventh consecutive quarter of status quo for these popular investment instruments. The rates for the upcoming quarter will remain exactly as they were for the previous quarter (October–December 2025), ensuring that investors in popular schemes like PPF, Sukanya Samriddhi, and NSC continue to earn steady, guaranteed returns. Running Interest Rates: Jan 1, 2026, to Mar 31, 2026 The Senior Citizen Savings Scheme (SCSS) and Sukanya Samriddhi Yojana (SSY) continue to lead the pack, offering the highest returns in the small savings basket at 8.2%. Meanwhile, the popular Public Provident Fund (PPF) has been retained at 7.1%, remaining a top choice for long-term tax-efficient savings. Small Savings Scheme Interest...